What is Cellphone Insurance?

September 25, 2024Gadget Insurance: The Ultimate Guide to Protecting Your Devices

In today’s tech-driven world, our gadgets have become essential to both our personal and professional lives. From smartphones to laptops, these devices connect us, help us work, and entertain us. However, with the increasing reliance on expensive technology, the risk of damage, loss, or theft has also surged. This is where gadget insurance steps in to offer peace of mind. Let’s dive into everything you need to know about gadget insurance and how it can save you from unexpected financial burdens.

Why Do You Need Gadget Insurance?

Owning the latest gadgets comes with a hefty price tag, and that means protecting your investment is more important than ever. Gadgets are prone to various risks such as drops, spills, theft, and software malfunctions. Without insurance, a single accident can leave you facing repair or replacement costs that could reach hundreds, or even thousands, of dollars.

Rising Costs of Gadgets

With smartphones, laptops, and even smartwatches becoming more sophisticated, their prices have skyrocketed. Replacing a damaged high-end smartphone like an iPhone or Samsung Galaxy can set you back significantly, often as much as $1000 or more. Insurance helps mitigate this financial risk.

Common Risks Faced by Gadgets

Gadgets face daily hazards. Whether it’s a cracked screen, theft at a coffee shop, or water damage from a spilled drink, the potential for accidents is endless. Without protection, repairing or replacing a gadget can feel like a serious financial blow.

How Gadget Insurance Saves You Money

Paying a small monthly or annual premium ensures that if something happens to your device, the insurance company will cover the bulk of the repair or replacement costs. Gadget insurance also covers scenarios that warranties don’t, such as accidental damage and theft.

Types of Gadgets Covered Under Gadget Insurance

Gadget insurance isn’t limited to just smartphones. Most policies offer coverage for a variety of electronics:

Smartphones

These are the most commonly insured gadgets due to their high usage and cost. The risks of dropping, losing, or having a smartphone stolen are higher than other devices.

Tablets and Laptops

Whether you use them for work or leisure, protecting your tablets and laptops is essential. Insurance covers damages beyond normal wear and tear, offering a lifeline when accidents happen.

Wearable Devices (Smartwatches, Fitness Trackers)

As wearables become more integrated into our daily lives, insuring them against accidents like water damage or theft is a smart move.

Cameras and Drones

Photographers and drone enthusiasts should consider insuring their expensive equipment. Drones, in particular, are prone to crashes, making insurance critical for hobbyists and professionals alike.

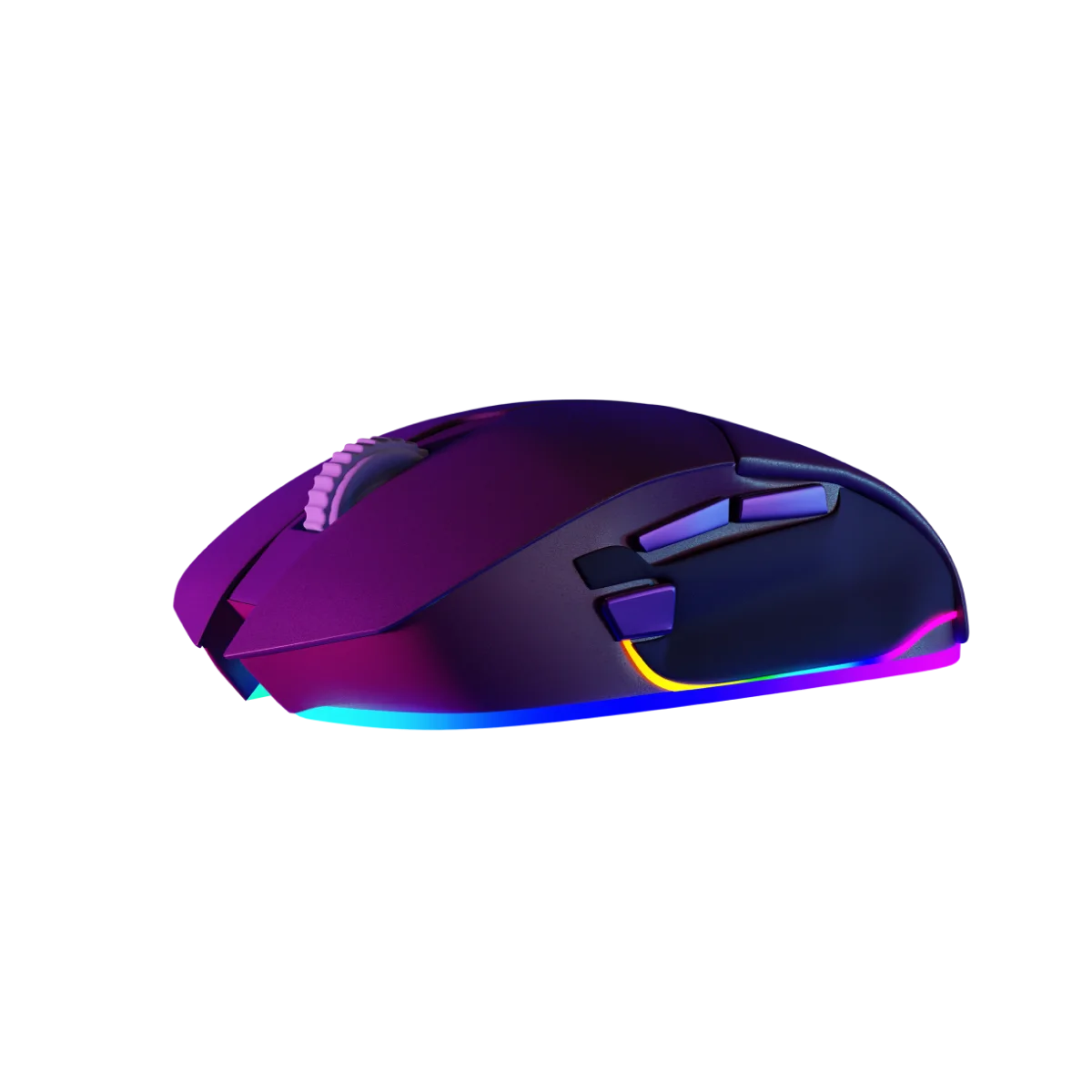

Gaming Consoles

Although less portable, gaming consoles are expensive investments that can benefit from gadget insurance, especially when they are subject to accidental damage or electrical failure.

What Does Gadget Insurance Typically Cover?

Most gadget insurance plans offer protection for a wide range of potential issues, such as:

Accidental Damage

Dropping your phone or spilling coffee on your laptop? Gadget insurance covers accidental damage, which is often the most common type of claim.

Theft and Loss

If your gadget is stolen, or you lose it in a public space, most insurance policies will cover the cost of a replacement, although there may be some exceptions or specific conditions.

Mechanical Breakdown

If your device suddenly stops working due to a mechanical issue outside of the manufacturer’s warranty, insurance steps in to cover repair costs.

Water Damage

Water damage is one of the leading causes of gadget malfunction. Whether your device was submerged in water or simply exposed to moisture, insurance can help cover repair or replacement costs.

What Gadget Insurance Does Not Cover

While gadget insurance is comprehensive, there are certain exclusions to be aware of:

Manufacturer’s Warranty Overlaps

Issues covered by a manufacturer’s warranty, like defects in materials or workmanship, aren’t usually covered by gadget insurance.

Cosmetic Damage

Superficial scratches or dents that don’t affect the device’s functionality are typically excluded from coverage.

Negligence and Intentional Damage

If the damage is due to reckless behavior or intentional acts, the insurance company may refuse to pay out.

Unauthorized Repairs

Using unauthorized repair services or tampering with your device may void the coverage under your insurance policy.

Factors to Consider When Choosing Gadget Insurance

Not all gadget insurance policies are created equal, so it’s essential to evaluate your options carefully. Key considerations include:

Cost of Premiums

The cost of insurance premiums varies based on the type and value of your gadget. Be sure to compare premium rates across multiple providers.

Deductibles (Excess Fees)

Most policies require you to pay a deductible when you make a claim. Ensure you’re comfortable with the amount you’ll need to contribute.

Worldwide Coverage

If you frequently travel, opt for an insurance plan that offers worldwide coverage, so your gadgets are protected no matter where you go.

Multi-Gadget Discounts

Some insurers offer discounts if you insure multiple devices, which can be a smart way to save money if you own several gadgets.

How Much Does Gadget Insurance Cost?

The cost of gadget insurance varies based on factors like the device’s value, the coverage limits, and the insurance provider. On average:

- Smartphone Insurance: $8–$15 per month

- Laptop Insurance: $10–$20 per month

- Wearables: $5–$10 per month

These are ballpark figures, and premiums can vary widely based on your location and device.

Top Gadget Insurance Providers in 2024

When choosing an insurance provider, it’s important to consider their reputation, coverage options, and customer service. Here’s a look at some top providers:

- Provider A: Known for affordable premiums and strong customer reviews.

- Provider B: Offers excellent worldwide coverage and fast claim processing.

- Provider C: Popular for multi-gadget discounts and robust accidental damage coverage.

How to Make a Gadget Insurance Claim

Filing a gadget insurance claim is usually straightforward, but knowing the process in advance can help you avoid delays:

- Notify Your Insurer: Contact them as soon as the incident happens.

- Provide Documentation: Gather proof of purchase, repair estimates, or police reports if necessary.

- Follow Up: Keep track of your claim’s status to ensure a speedy resolution.

Conclusion

Gadget insurance is an essential safety net for anyone who relies on expensive devices in their daily lives. Whether it’s a smartphone, laptop, or wearable, the right insurance policy can save you significant repair or replacement costs. By carefully selecting a plan that suits your needs, you can enjoy your gadgets with peace of mind, knowing they’re protected.

FAQs

- Is gadget insurance worth it? Yes, if you own expensive devices, gadget insurance can save you from large repair or replacement costs.

- Can I insure multiple gadgets under one policy? Many insurers offer multi-gadget discounts if you cover more than one device.

- Does gadget insurance cover theft? Most policies cover theft, but it’s important to check the specific conditions in your plan.

- What is the average cost of smartphone insurance? The average cost ranges from $8 to $15 per month, depending on the phone and coverage.

- Do I still need insurance if my gadget has a warranty? Yes, warranties don’t cover accidental damage or theft, which are common with gadgets.